Fabric

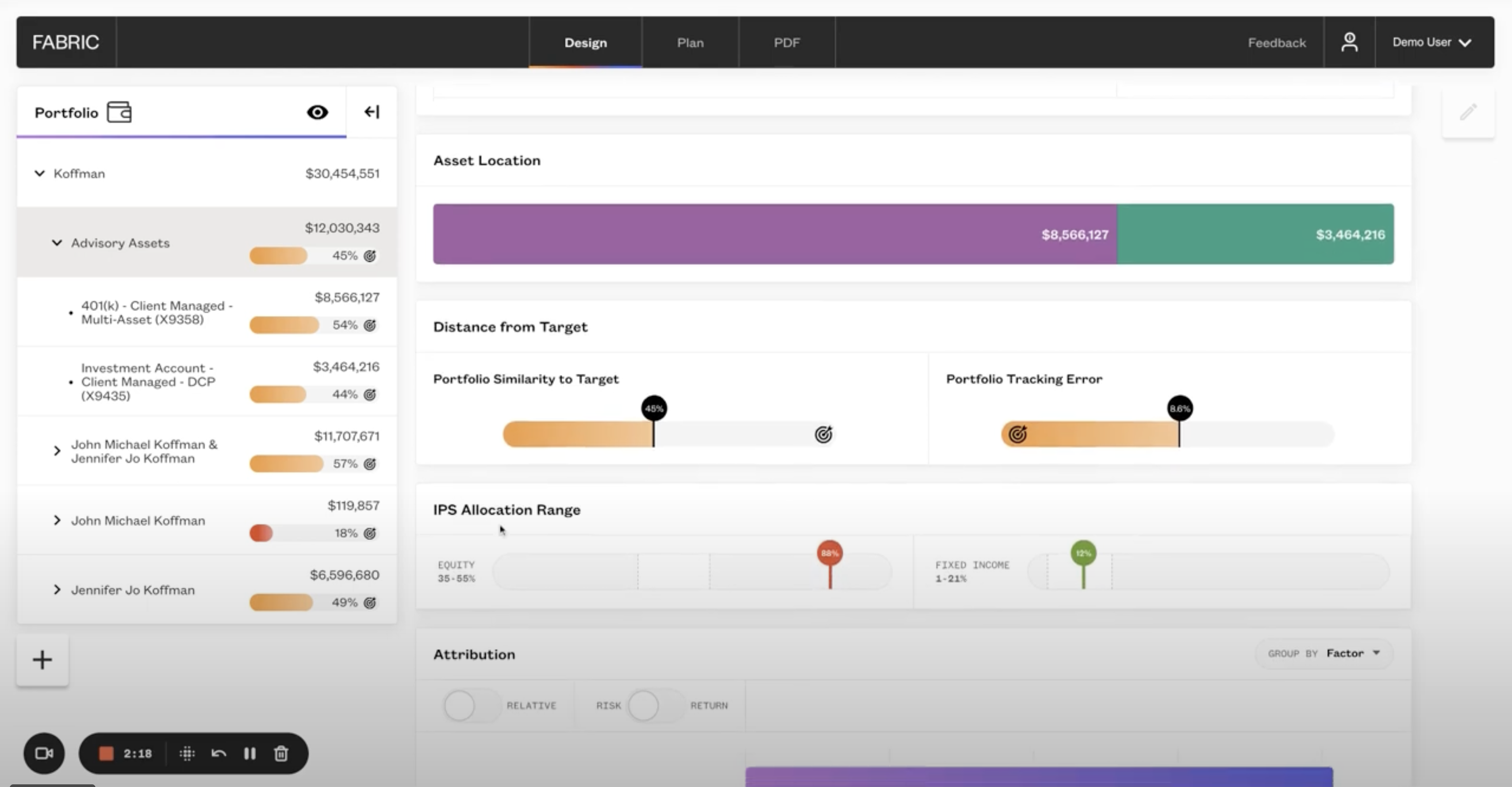

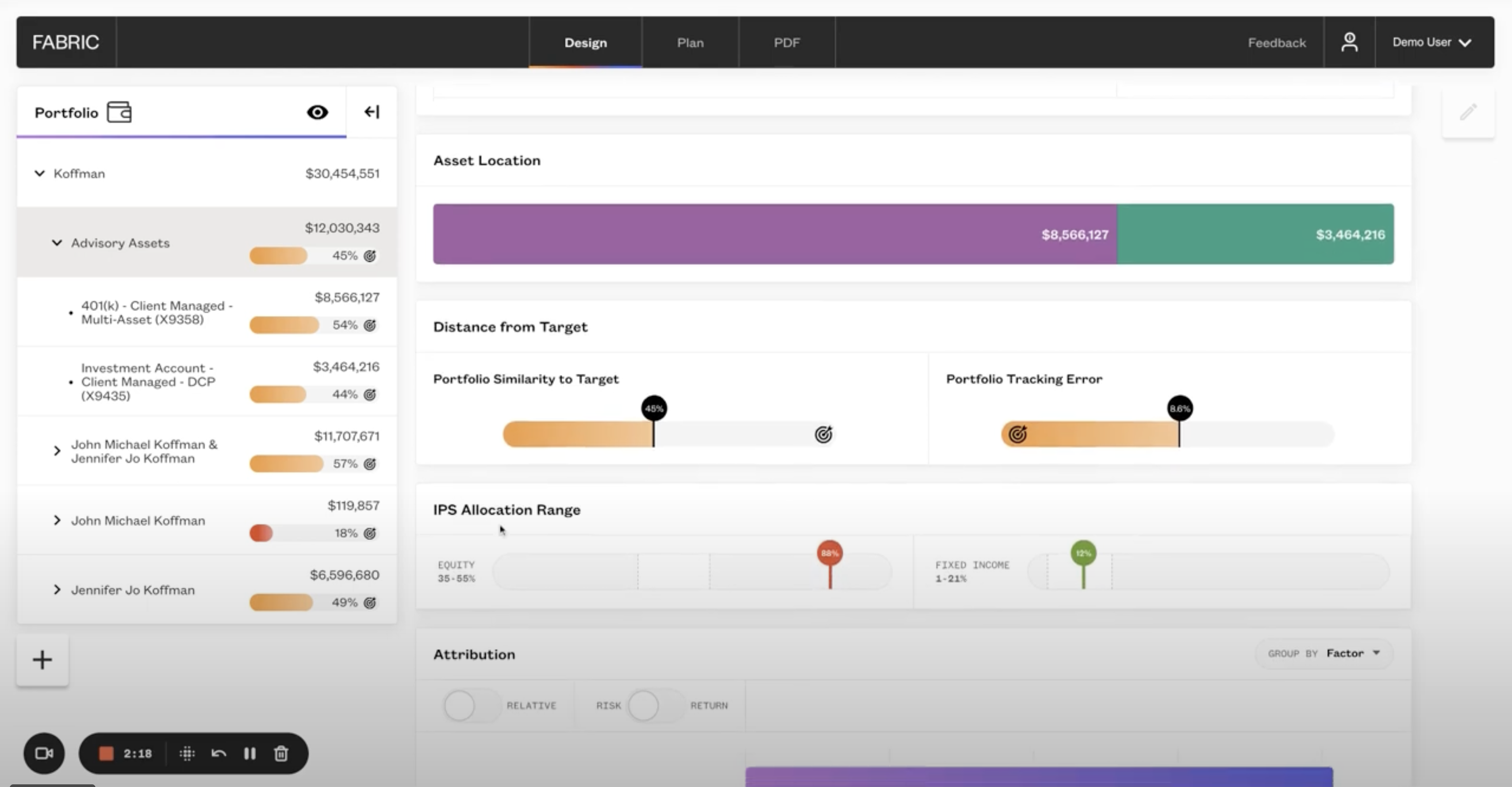

Independent financial advisors managed $500B+ in client assets using Fabric's platform. We streamlined complex risk workflows, allowing new firms to onboard and implement the platform in under 1 day.

$500B+

AUM on Platform

95%

Retention

Loading

From 0-to-1 startups to enterprise AI platforms, I build products that empower users and drive measurable business impact.

Independent financial advisors managed $500B+ in client assets using Fabric's platform. We streamlined complex risk workflows, allowing new firms to onboard and implement the platform in under 1 day.

$500B+

AUM on Platform

95%

Retention

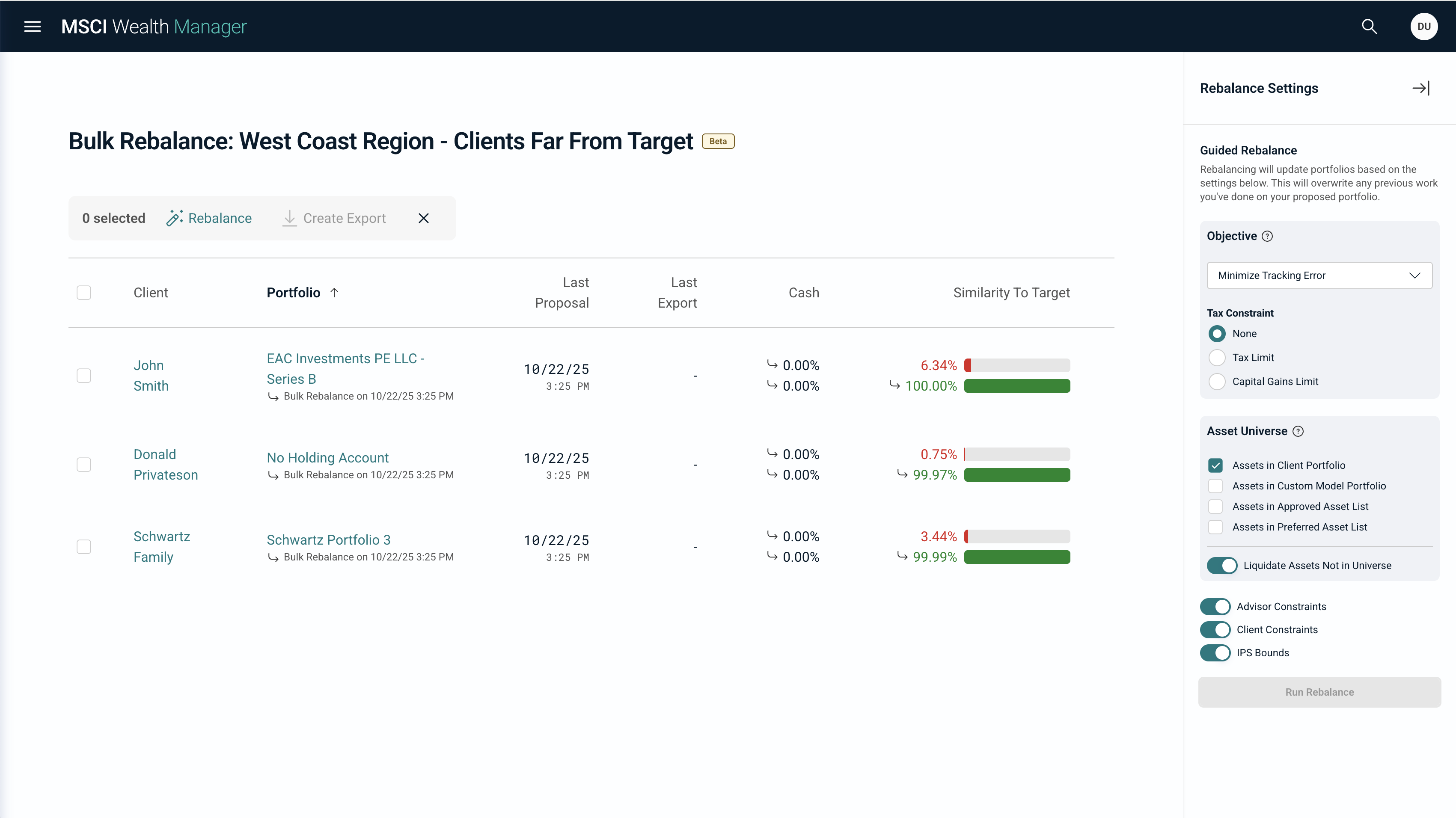

Scaling personalization to the world's largest private banks. Aligning CIO strategy to client portfolios across $3T+ in assets and 20+ countries.

$3T+

Assets Managed

20+

Countries

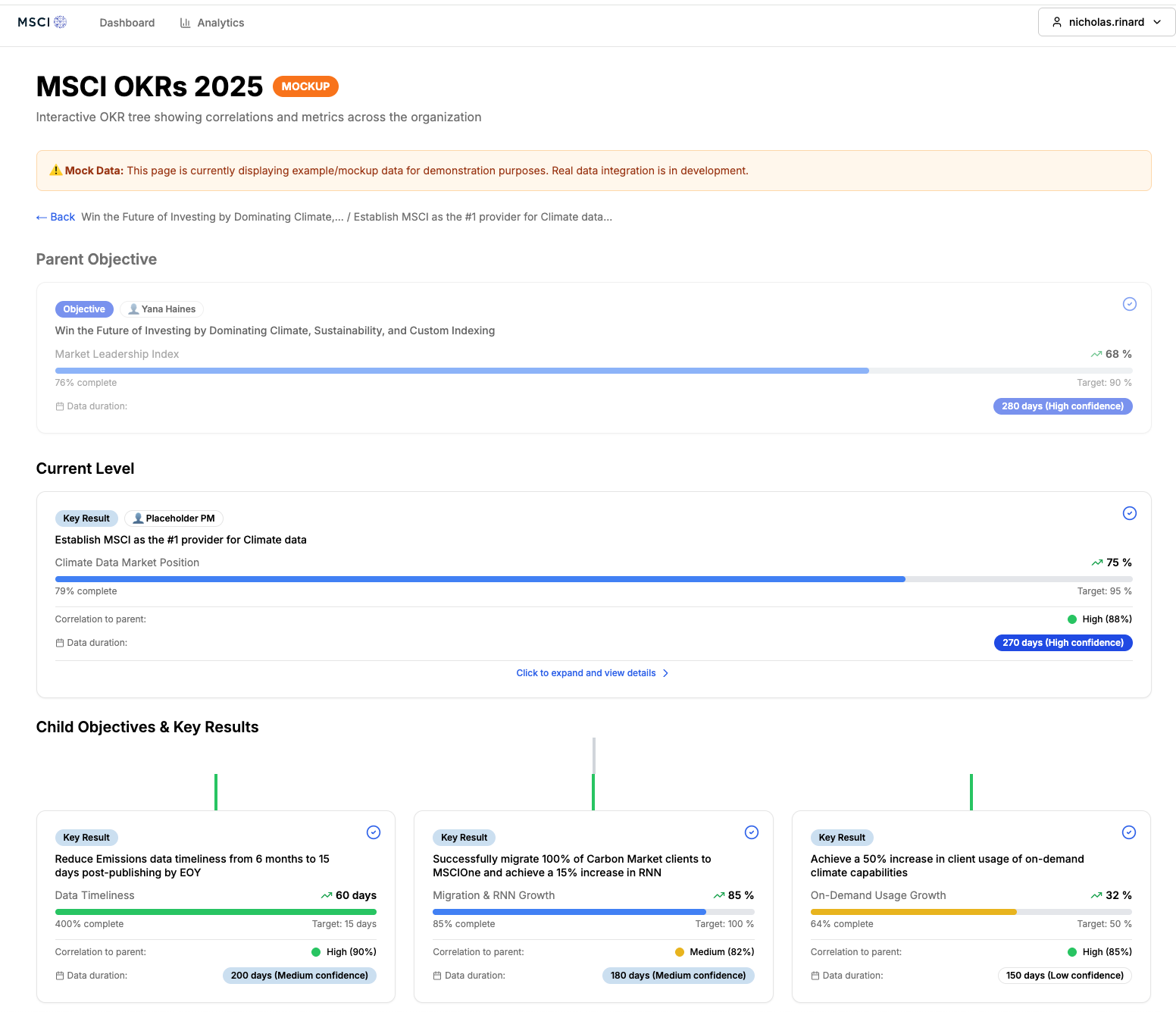

Transforming a large organization with AI. Empowering engineers across the org with tools that drove measurable productivity gains and executive investment.

15%

Productivity Gain

Exec

Investment Secured

A custom CMS built to orchestrate a "team of models" (Gemini, Claude) for content creation. Proof of concept for agentic workflows.

10×

Content Output

Multi-Model

Orchestration

Built proprietary risk analytics tools for biotech hedge fund, enabling real-time portfolio risk assessment.

Redesigned customer onboarding for healthcare SaaS platform, streamlining setup and reducing time-to-value.

Designed and optimized ultrafast laser hardware for scientific research applications.

I'm always open to discussing new opportunities, partnerships, or ambitious projects that drive real agency and impact.